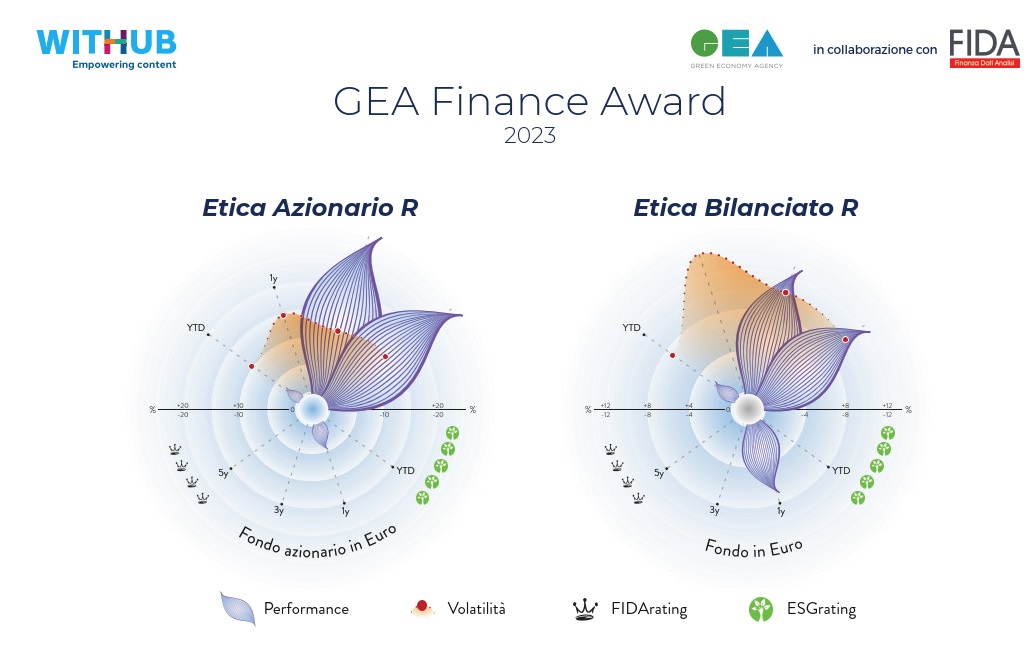

The Etica Azionario and Etica Bilanciato funds were recipients of the “GEA Finance Award”, the first award in Italy dedicated to collective investment funds classified pursuant to Art. 9 of Regulation EU 2019/2088 or SFDR.

These funds were included among the most virtuous in terms of sustainability, and stood out for their risk/return ratio efficiency in their reference categories.

A step closer to sustainability

The Gea Finance Award is recognised by Withub, the editor of the Green Economy Agency (GEA) press office, which focuses on the ecological transition and sustainability.

In conjunction with Fida, the leader in analysing financial rating and ESG data, Withub drew up a ranking of the 10 best collective investment funds.

The goal? To encourage the world of asset management to increase investments in the ecological transition. More specifically, the award seeks to facilitate Italian and European companies and the production system in achieving the climate targets set in Fit for 55, to reach Net zero by 2050.

The role of finance in a sustainable economy

Etica Azionario and Etica Bilanciato were the only Italian funds included in the ranking.

This award, representing significant recognition for Etica Funds, once again highlights the crucial role that finance can play in driving private savings towards a more sustainable economy, which can generate value for the environment and companies over the longer term.

| Fondo azionario in Euro | Equity fund in Euros |

| Fondo in Euro | Fund in Euros |

| Volatilità | Volatility |

The Award was presented during the “Green Economy Finance – The role of finance and savings in support of the ecological transition” event that was held in Rome on Thursday, 22 June, during the “David Sassoli” Europe Experience. The event also included various debates on the role of finance and savings in promoting the investments needed for the ecological transition.

The Method

The method used to draw up the list of the 10 best collective investment funds was based on a joint analysis of the level of sustainability, assessed in relation to the SFDR regulation and a third system, the FIDA ESG Rating, as well as the fund’s ability to achieve significant results in terms of return and risk, based on the FIDA Rating system. In this regard, funds belonging to the “reference universe” that met the “selection criteria” were recognised.

Reference universe:

Italian and foreign collective investment funds sold in Italy, retail classes.

Selection criteria:

- Funds complying with Art. 9 of SFDR.

- Maximum sustainability level measured using the FIDA ESG Rating (5 wish trees)

- Excellent performance in terms of risk and return measured using the FIDA Rating (4 and 5 crowns)

For more information, and to review the classification, reference is made to the GEA Agency website.

Disclaimer

This article contains marketing communications from Etica Sgr S.p.A. (“Etica”). Information from the sources indicated in this document has been deemed to be reliable and in good faith by Etica, which provides no guarantee regarding its accuracy or reliability and declines any responsibility for any damage or loss that may result from the use of or reliance on this information. The information and data in this article refer to market conditions at the time of its publication and may therefore undergo changes in relation to evolving financial market trends. Etica is under no obligation to amend, integrate and/or update the information and data contained in this article. Any information contained in this article regarding previous returns, outlooks or hypothetical future prospects, similarly, any investment strategy or assessment or other information that may be obtained from the article is provided for illustrative purposes only and should not be considered as a reliable indicator for future trends. Etica issues no statement or guarantee, nor does it assume any responsibility as to whether any assessment or forecast made on the basis of this article is achievable, reasonable or reliable. Investors should make an investment decision only after having understood its overall characteristics and the degree of exposure to the related risks by carefully reading the KID and the Prospectus of the individual funds, which — together with the information on sustainability pursuant to Regulation (EU) 2019/2088 — can be found at www.eticasgr.com/regolament-2088 and www.eticasgr.com/documenti on this internet site. Recipients of this message assume full and complete responsibility for using the information contained in this article as well as for any investment choices made that are based on it, as any use of this communication as support for investment choices is not permitted and is at the investor’s full risk.