Stewardship Report 2025 is the name of the document that analyzes the results of the dialogue with management, of the active shareholding carried out with the companies in which Etica’s funds invest and of the advocacy activity carried out with governments, regulators and standard setters.

The goal of stewardship is to preserve the value of investments

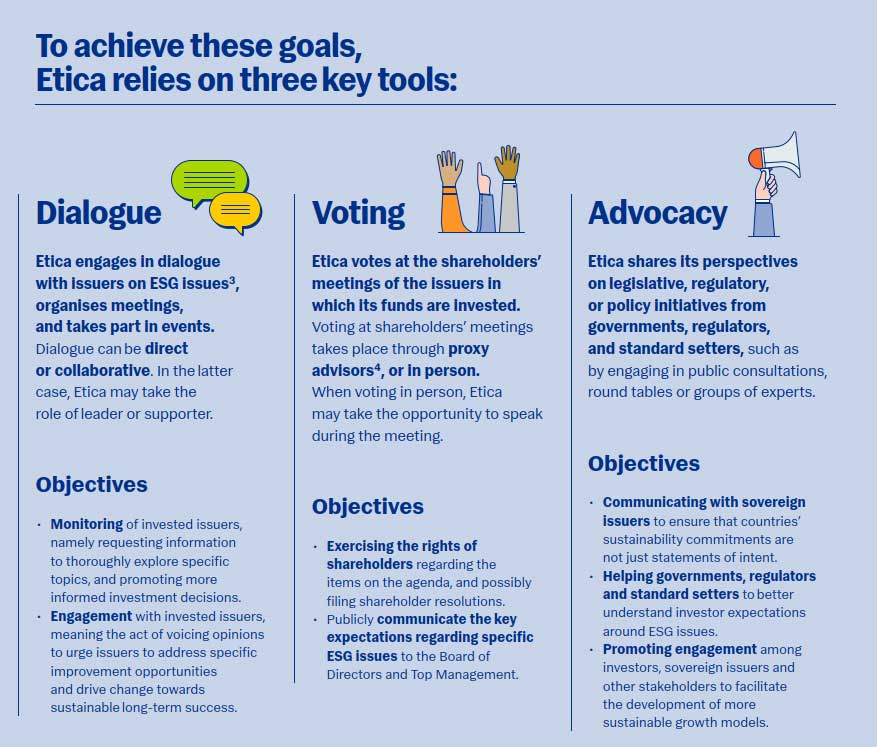

The stewardship1 activity of Etica aims preserve and enhance the value of the assets we have been entrusted with by our clients, and at the same time responsibly managing the environmental and social impacts of our investments. In fact, targeted stewardship activities by an asset managers can influence the strategy of investee companies, generating long-term value for companies and investors alike.

The Etica stewardship activities set two objectives:

- in the medium term, to promote the integration of material or salient social and environmental factors in the strategy and risk management of investee companies.

- in the long term, the generation of a stable stream of risk-adjusted returns, and the enhancement of the oversight of societal and ecological impacts.

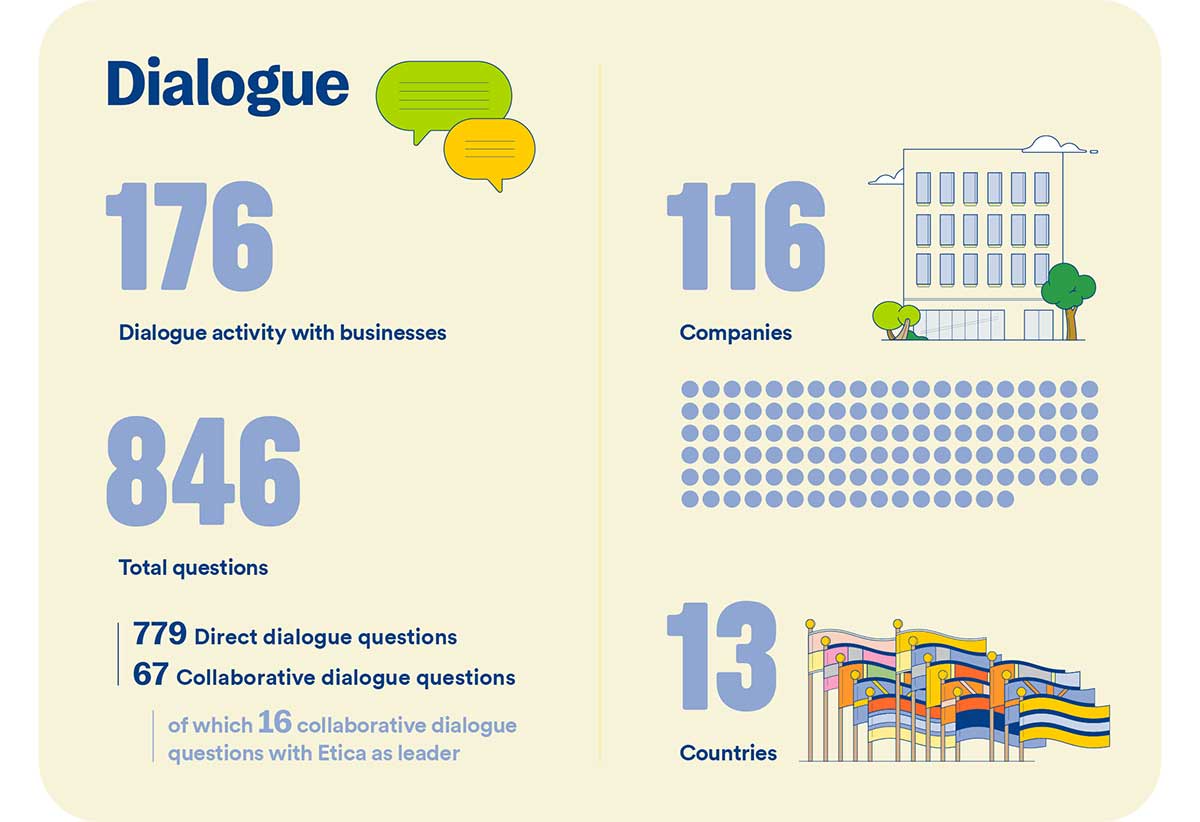

The results of the dialogue

We carried out additional biodiversity- related activities, reinforcing the partnership with the CDP Forest Champions programme. This led Etica to be included in the list of international best practices in the Nature Positive for Climate Action publication by the UNFCCC. Encouraged by the feedback following our participation in the PRI Tax Reference Group, we structured a dialogue campaign on taxation, which allowed us to identify the highest-risk companies by the end of the year. We recently launched a campaign on the responsible use of artificial intelligence, signing an Investor Statement on Ethical AI and taking part in the Collective Impact Coalition for Ethical AI.

-

Case study on Climate Change - Hera

Dialogue

In 2021, we launched engagement with Hera on the topic of a just transition. Our objective was to promote the development of a transition strategy towards a business model with a lower environmental impact that integrated fairness in relation to the main stakeholders: employees, suppliers, and local communities. To achieve this goal, starting in 2021 we held multiple meetings with the company, also involving the Engagement Work Group of the Italian Social Investment Forum.

Result

Hera has always shown great eagerness to engage in dialogue with Etica Funds. As early as 2022, the company began a tangible process to integrate the just transition into its strategy. Today the just transition is one of the founding elements of the company’s sustainability strategy, and is integrated into its business model. The Hera Group’s 2023-2027 Business Plan explicitly calls for the promotion of a just transition. In this regard, in 2024, Hera signed a Decent Work Agreement with leading trade unions, which envisages, among other things,

2,600 new hires and 60 million euros of investments in training and development over the course of the plan.

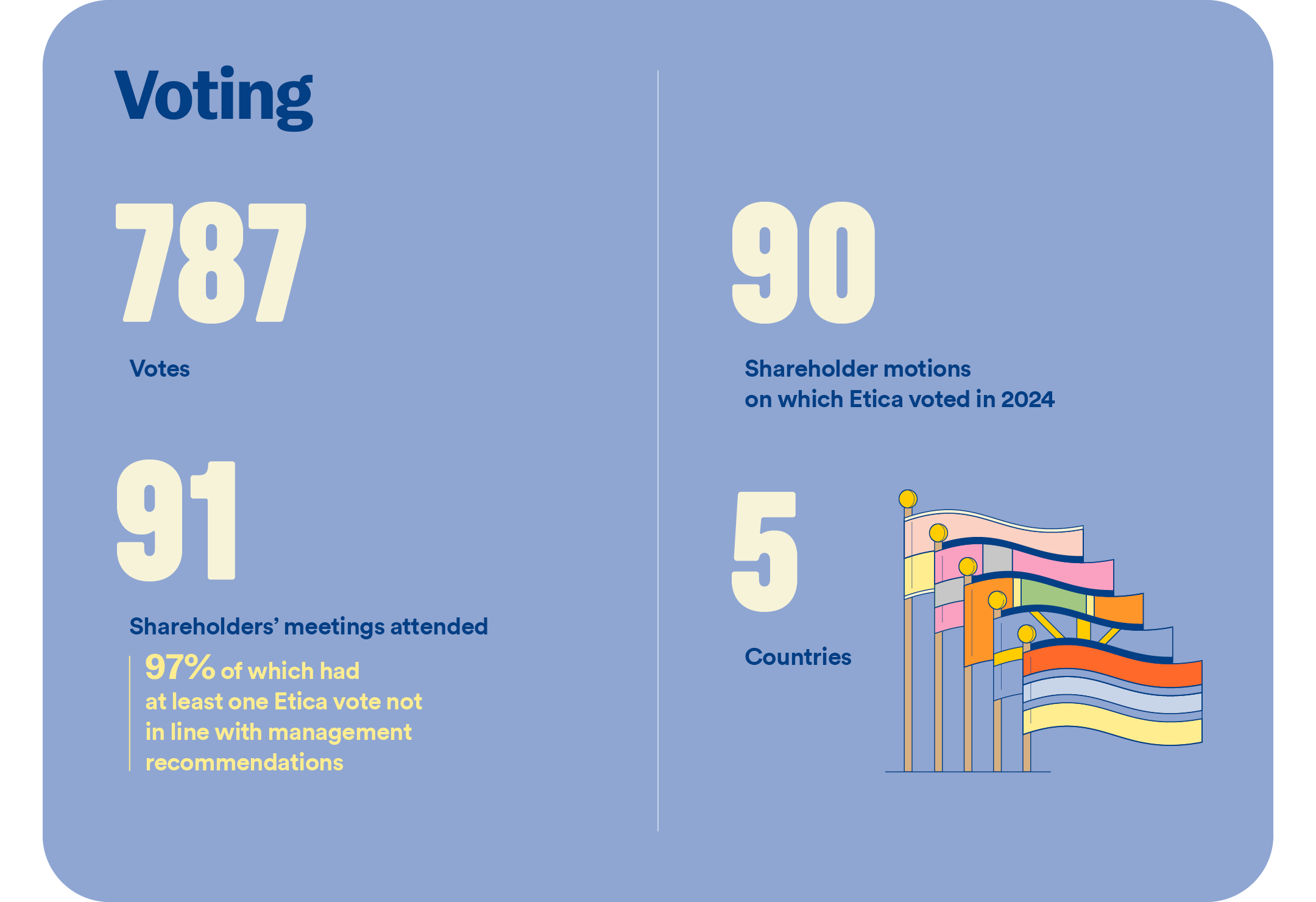

The results of the vote

We began testing the voting policy developed for the market in Great Britain, which allowed us to identify the risk of excessive remuneration of top management. We continued to participate in the proceedings of the Managers’ Committee, to promote the representation of minority shareholders in the governing bodies of Italian companies. We supported 90 shareholder resolutions, focusing in particular on topics such as shareholders’ rights, the management of political contributions, and the power balance in the Board of Directors. In this respect, we also started to identify and vote on so-called anti ESG motions, which seek to hinder the progress of companies on topics such as climate change, gender equality, and biodiversity.

-

Case study on Sustainability governance - Carrier Global Corp

Vote

At the annual shareholders’ meeting, Etica supported a shareholder motion that asked the company to publish detailed information about its lobbying activity and its membership of associations or groups of interest. The objective was to guarantee transparency and allow shareholders to verify that direct or indirect lobbying activities were in line with the strategic objectives of the company, as well as shareholder interests.

Result

The motion received the support of 23% of voting shareholders. Despite not having received a majority vote, in 2024 the company took a significant step towards greater transparency by publishing a section on its website dedicated to lobbying policies. The website now also contains the list of all trade associations and organisations of which the company is part.

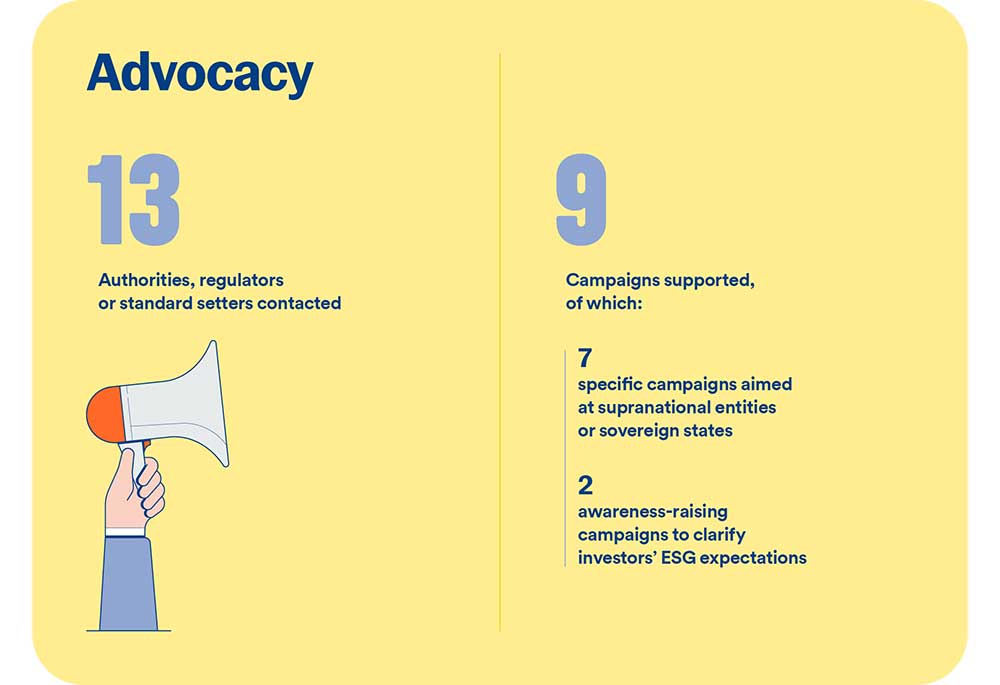

The results of advocacy

ICAN on the issue of nuclear weapons, launching the Nuclear Weapons Free Finance Initiative. The initiative is open to support from institutional investors. Since 2022, the campaign by Etica and ICAN has been signed by over 100 financial institutions and in 2024 it received formal support from the Italian Social Investment Forum. We ramped up the collaboration with ICGN on governance, taking part in the network’s Global Policy Committee and contributing to the creation of investor viewpoints on artificial intelligence and workers’ voice in corporate decision-making. In relation to tax, the Australian parliament approved the law for the implementation of country-by-country reporting. This arrangement will require the large multinational companies that operate in Australia to publish specific information for each country, in line with the indications expressed by Etica during public consultation on the law.

-

Case study - Australian regulator

Participation in the public consultation on the regulation for country-by-country

tax reportingAdvocacy

In 2024, Etica also participated in the public consultation of the Corporate and International Tax Division of the Australian Treasury. In the response to the regulator, following on from what we wrote during a previous consultation in 2023, we highlighted the usefulness of reporting in line with international standard GRI 207, specifically indicator 4 on country-by-country reporting.

Result

In December 2024, the public country-by-country reporting measures received Royal Assent and came into force in Australia. The public reporting measures affect several multinationals operating in the country, and require the publication of some tax-related and other information for each individual jurisdiction, together with a statement on the tax approach used, for reporting periods starting on or after 1 July 2024. This regulation will allow Etica to have better information to assess the risk of aggressive tax policies adopted by companies. Furthermore, this regulation could encourage the request for a similar level of transparency by regulators in other countries.

Download the Report 2025

Please read the Legal Notice.