At the end of this past November, the eighth edition of the European SRI Study was presented in Brussels. This study on the industry of socially responsible investments in Europe is conducted by Eurosif (the European forum for socially responsible investors) every two years, and in the 2018 edition, it analysed the 2015-2017 period.

European SRI Study 2018

At the end of this past November, the eighth edition of the European SRI Study was presented in Brussels. This study on the industry of socially responsible investments in Europe is conducted by Eurosif (the European forum for socially responsible investors) every two years, and in the 2018 edition, it analysed the 2015-2017 period.

The presentation of the study is now a standing appointment for operators in the sector. There, they can find the SRI sector trends for their own countries and also gain insight by comparing what is happening in the other European countries.

The 2018 edition is particularly significant because the European Commission published it at a moment when the financial sector was openly and directly involved, in effective and concrete support of sustainable growth in Europe, which began officially last March with the publication of the Action Plan on Financing Sustainable Growth. The presence of Valdis Dombrovskis, Vice President of the European Commission responsible for Financial Stability, Financial Services and the Capital Markets Union, for the keynote speech at the European SRI Study presentation event in Brussels confirmed the European Commission’s great commitment and the challenging objectives it has set itself.

Sustainable and responsible investments in Europe

The Eurosif study involved 263 asset managers and asset owners, for a total of €20,000 billion in assets under management, thus representing 79% of the entire European asset management market, estimated by EFAMA at €25,200 billion.

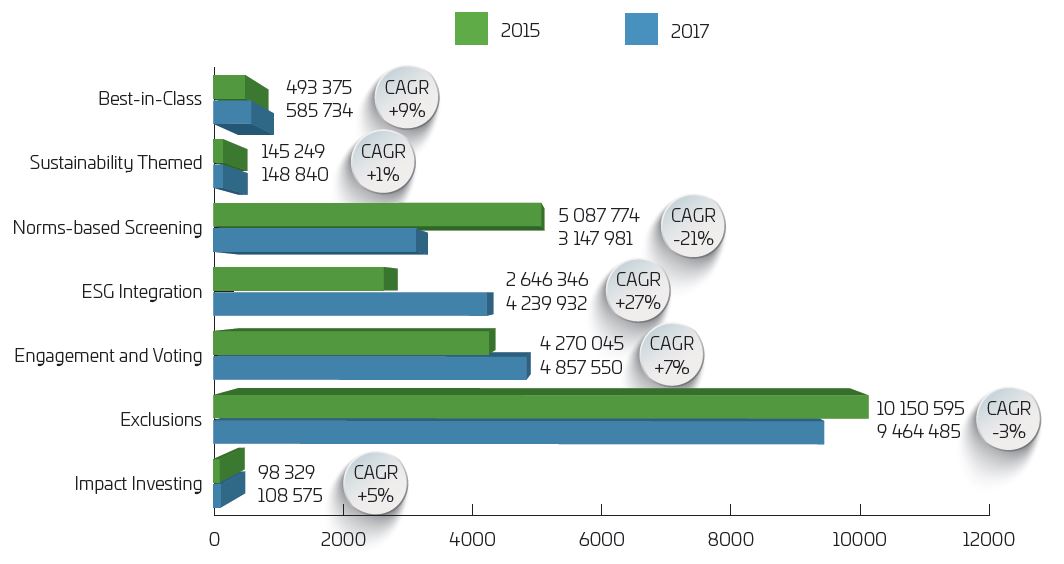

SRI strategy in Europe – Overview

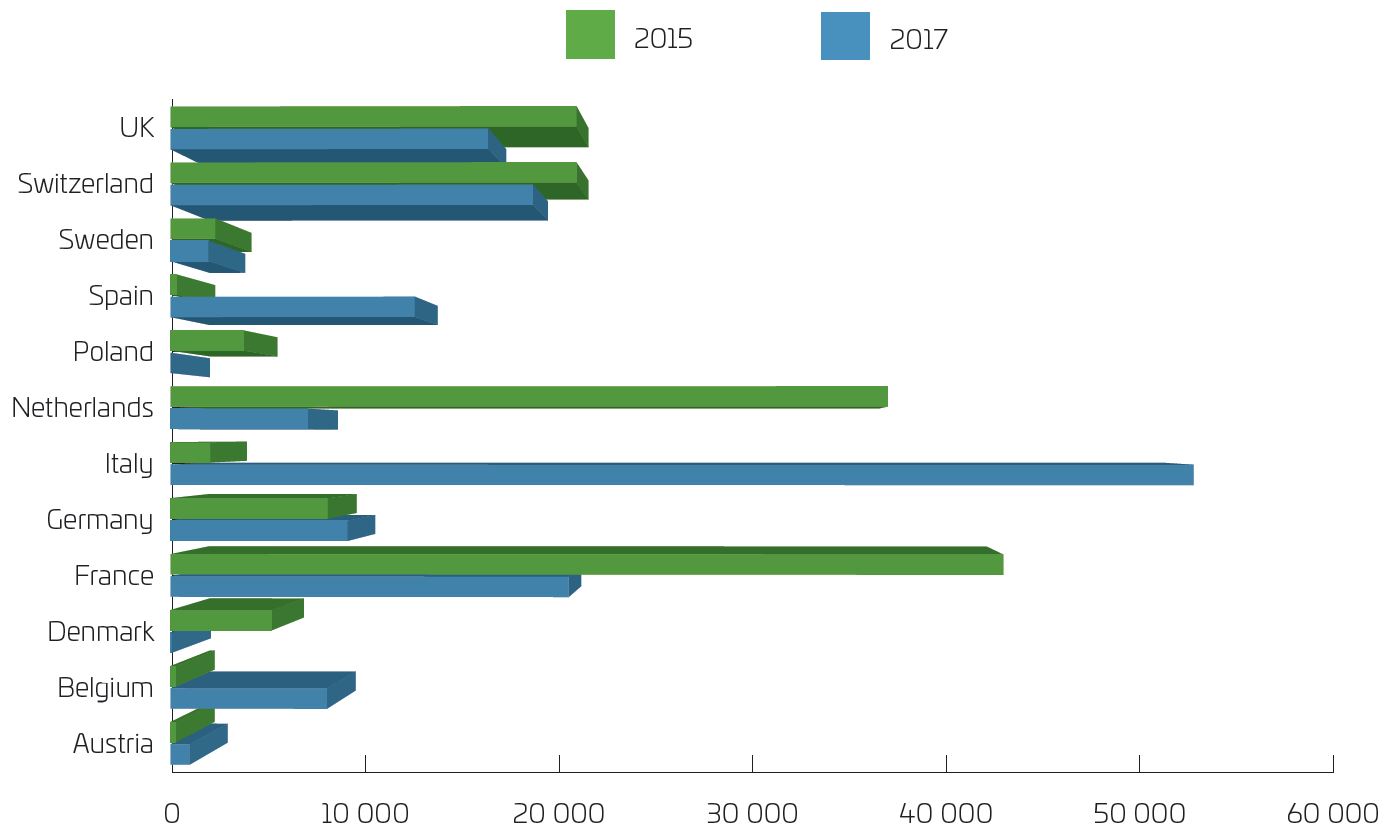

One of the most interesting results regards one of Europe’s main SRI strategies. The study confirms the very widespread use of exclusion criteria in Europe, although down compared to the previous years, and the rapid growth of ESG integration. The other strategies showing positive growth are Engagement, Best in Class and Impact Investing. On the contrary, European investments in thematic funds remain substantially stable, a trend which grew very quickly between 2013 and 2015 and literally exploded in Italy in 2017.

Growth of investments in thematic funds by Country

In Italy, Institutional Investors are boosting SRI investments

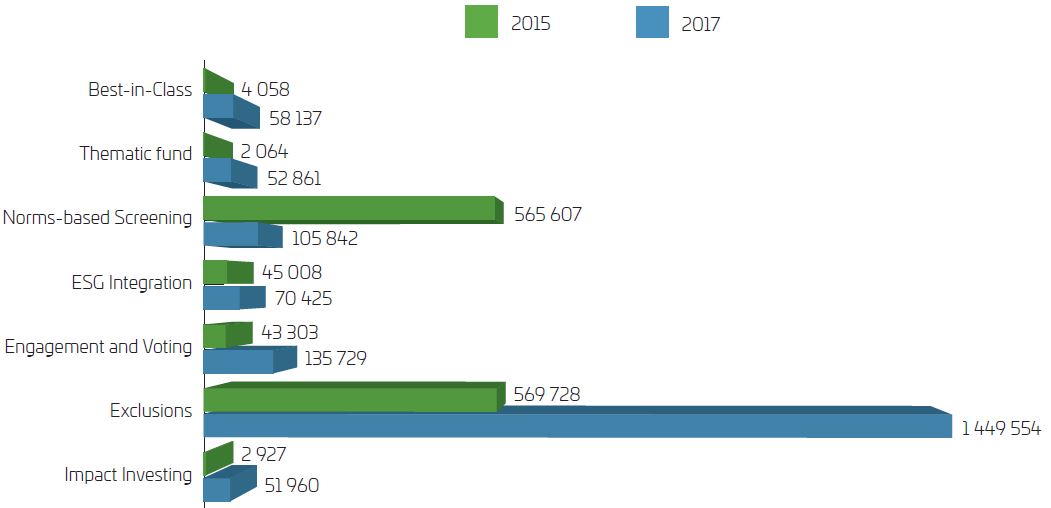

The Eurosif report stresses that, for the Italian market, unlike what is happening in other European countries, socially responsible investments continue to be mostly allocated to the retail segment. Despite this, the latest period saw a growing interest in ESG themes on the part of institutional investors, especially those involving insurance and pensions.

The positive trend among Italian pension investors was also confirmed by the study that the Forum per la Finanza Sostenibile (Italian Sustainable Investment Forum) conducted in collaboration with Mefop (a company for the development of the Italian Pension Fund Market), presented for SRI Week, showing that almost half (44%) of the sample of pension investors contacted declared a strong commitment to applying ESG criteria in their portfolio.

SRI strategy in Italy – Overview

The pressure of European legislative measures on the subject of sustainability will certainly have a significant impact on the development of the SRI industry in Italy in the medium and long term. Besides, the growing attention of pension and insurance investors is facilitated also by a number of specific regulations and measures in the sector (for example the recent IVASS [Istituto per la Vigilanza sulle Assicurazioni – Italian Institute for the Supervision of Insurance] regulation on the governance of insurance companies). However, this new year will certainly see some very important changes (one example is the new European taxonomy) which should determine a rise in the involvement of all operators in the sector, above all institutional, and a change in their approach, with financial investments increasingly tied to fiduciary duty.

The path is marked, and many operators are already following it and making great strides. The European Commission, in the meantime, is not wasting time and began the new year publishing a draft of measures regarding how investment firms and distributors of insurance products must consider sustainability criteria when consulting with their clients. The timing, established in March 2018 by the Action Plan, is clear and tight, and the Commission seems determined to stick to it.

Working towards a low carbon impact economy

Etica Sgr, for its part, is firmly intent on making its contribution. Focused since its foundation exclusively on socially responsible investments, it offers a range of totally SRI funds on the market — with €3.6 billion in assets under management, a 15-year track record and always considerable yields — which come with, since 2008, an ESG advice service for institutional investors that today involves approximately €11 billion in assets.

In addition, to tackle the commitments that the European Commission is requesting in terms of attention to environmental themes, Etica Sgr has widened its product range, launching a new fund in October, Etica Impatto Clima (Etica Climate Impact), whose primary objective is to support the transition towards a low carbon impact economy, without in any way neglecting the more general, social and governance analyses which have always distinguished Etica Sgr’s proprietary ESG (Environment + Social + Governance) analysis model.

DISCOVER ETICA IMPATTO CLIMA

Responsible finance Institutional investor