ESG risk: why do we need a risk metric based on environmental, social and governance factors?

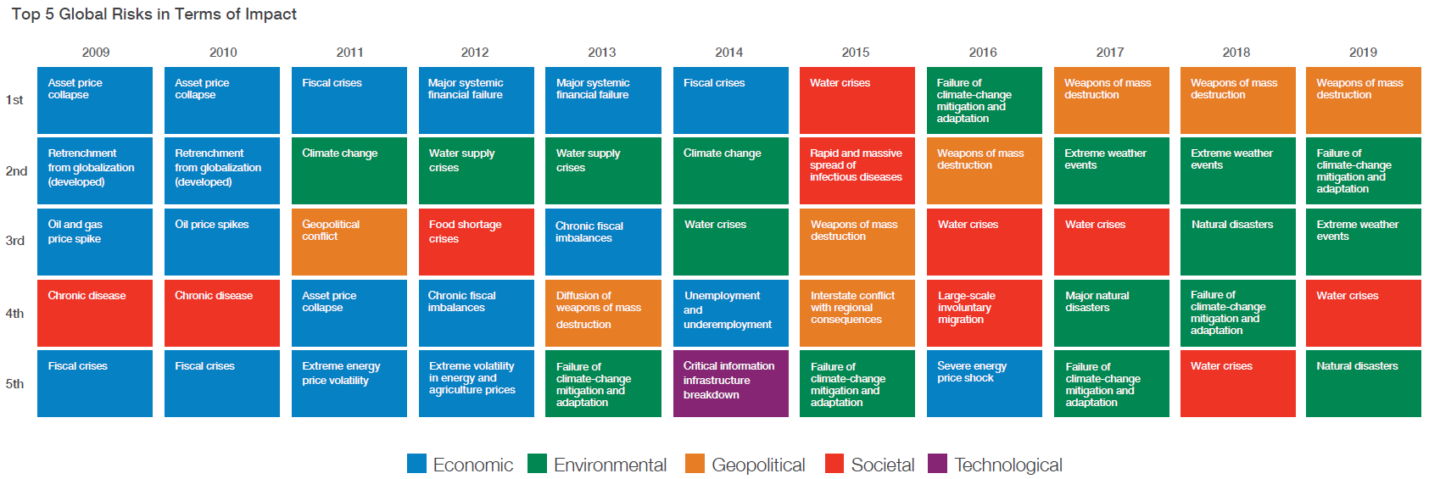

According to 2019 data from the World Economic Forum, the types of global risks have changed in the past 10 years, and while economic risks predominated in 2009 and 2010 we now see the growing impact of environmental and social risks, particularly since 2017. Not only have these risks become more common, they have also become more significant given the extent of the damage they can cause.

Recent finance-related events demonstrate how social and environmental irresponsibility expose companies to serious risks, such as reputational and operating risks, which can also affect financial returns.

Etica Sgr is a pioneering Italian asset management company for sustainable and responsible investments, with a track record dating back almost twenty years. Etica Sgr’s investment solutions aim to create income opportunities in the medium to long term, focusing on the real economy and rewarding companies and countries with the highest environmental, social and governance (ESG) ratings.

We have always been convinced that analysing and selecting companies and countries from an ESG perspective is an important driver for long term value creation and for mitigating financial and reputational risks.

ESG Risk and financial risk

At Etica Sgr we have developed a proprietary metric to measure ex ante the risk resulting from factors caused by ESG problems. The importance of this metric is also confirmed by robust evidence showing a close connection between financial risk, represented by undiversified VaR (a measurement that shows the potential loss of an investment position within a certain time frame) and extra-financial risk for all asset classes and all sectors and countries.

A new study reveals the functions of ESG Risk

Our desire to produce new studies on this issue led us to analyse and further develop the characteristics of ESG Risk and its potential.

A recent scientific publication by Etica Sgr, produced in collaboration with the scientific and academic community and presented at the 12th International Conference on Risk Management, showed that the ESG Risk metric helps optimise the diversification of portfolios and improve estimates of financial volatility, especially over the long term. Let’s take a closer look at these two key results.

Managing portfolio diversification

Growing attention to sustainability and responsibility in investments has led to increased availability of ESG data and information, as well as a growing trend for the inclusion of ESG criteria in asset managers’ investment strategies. Our ESG Risk metric allows us to study and gain insight into the analysis and selection processes that investors should use when building a diversified portfolio.

Empirical evidence shows that within the process for selecting issuers, certain typical analysis factors – like the company’s market value, the governance characteristics and the country risk (in terms of control of corruption and regulatory quality) – have a strong influence on the ESG Risk metric. A number of examples are set out below.

A lower ESG Risk will more likely be found in the following cases:

- Market value: companies with a market value higher than their competitors.

- Governance: large companies with a diversified skill set in decision-making processes, and with precise methodologies for managing complex decisions, are also those most willing to invest in innovative long term strategies aimed at sustainability.

- Country risk: globalised, digitalised companies capable of developing competitiveness beyond borders and demonstrating good management of international relationships.

We can therefore state that ESG Risk helps investors with portfolio analysis, reducing entropy (disorder) and optimising the diversification of the portfolio itself.

Improving the estimate of a portfolio’s financial risk

The second relevant implication of this study relates to the power of the ESG Risk metric to mitigate and reduce the unexpected volatility of a portfolio over the medium to long term.

Sustainable and responsible strategies with long term objectives should take the ESG Risk analysis into consideration in order to obtain financial, as well as social and environmental returns. Traditional financial ratings do not show the same tendency to mitigate the relationship between ex ante financial risk and the ex post volatility of a portfolio in the short or medium term.

Therefore investors who establish their own investment strategy without considering ESG Risk run the risk of losing control of the volatility of their own portfolio, as well as making their investments more vulnerable, particularly during economic downturns.

Financial analysis and ESG analysis: a duel lens to look further afield

The results of this study therefore make an interesting contribution both to financial theory and practice, particularly in relation to asset management. In addition to traditional financial risks it is increasingly important to consider and manage risks arising from ESG factors that often translate into significant economic risks.

Any investors who supplement their financial analysis with aspects relating to ESG issues may therefore have a competitive advantage in risk management in the long term.

Before subscribing, please read the KIDs and Prospectus available from placing agents.

The placement of the “Linea Valori Responsabili” and “Linea Futuri Responsabili” funds is only available in Italy. For further information, please refer to the Italian version of the website.