What is the European Union’s Green Taxonomy? How does it work? Why is the European Commission seeking more clarity on sustainability? In this article, we review the history, definition and developments of the European Taxonomy, which entered into force on 31 December 2021.

The work of the European Commission

Every ESG ratings agency, asset manager and investment fund has its own definition and applies its own criteria and methodology when selecting a portfolio of sustainable investments. And while the criteria may be valid and the methodologies robust, they are anything but universal and, therefore, cannot be directly compared. In view of this, for around four years, the Commission has been working to establish a clear definition of which economic activities – and which investments – are considered sustainable.

In March 2018, the EU’s executive body launched a major programme to create a body of regulations on sustainable finance: the Action Plan on Sustainable Finance. The EU has made the reasoning for this decision clear: the economy has to lower its environmental impact. However, the commitment comes with a steep price tag in the short term, €180 billion per year. This is the cost to transition to a low carbon economy according to Brussels. According to the Commission, public funds aren’t enough.

It will also require input from private equity. Specifically, Brussels has set the target of considering the financial sector as the main instrument to direct capital towards responsible business within the framework of sustainable economic development.

EU Green Taxonomy: the language of sustainability

The European Commission’s work on sustainable finance hinges on the Taxonomy, the classification of economic activities that can be defined as “sustainable” or, more precisely, “environmentally sustainable”. “It is a practical guide for politicians, enterprises, and investors,” explains the European Commission, “on how to invest in economic activities that help to promote an economy that will not have a negative environmental impact”.

The Commission also specifies that the Green Taxonomy is not:

• a mandatory list of economic activities in which investors should invest;

• a list of mandatory requirements for public investments;

• a list of mandatory environmental performance requirements for companies or financial products;

The Sustainable Finance Taxonomy Regulation came into force on 13 July 2020, following the publication of Regulation (EU) 2020/852 in the Official Journal on 22 June 2020. Regulation 2020/852, otherwise known as the Taxonomy Regulation, is supplemented by a key building block, the technical screening criteria that must be met to achieve the sustainable activity label, published in the form of Delegated Acts. These were due to be published before the end of 2020 but were postponed several times due to opposition from certain Member States.

Green Taxonomy and technical screening criteria for two (out of six) climate objectives

Specifically, which activities can be defined as environmentally sustainable? And under what conditions? These are the questions that the much-awaited technical criteria aim to answer. The criteria established the specific thresholds that must be met for an activity to qualify as environmentally sustainable. For example, what is the maximum amount of CO2 that an activity can emit?

But let’s take one thing at a time. What exactly does the European Taxonomy include? Which targets must an economic activity contribute to in order to be considered environmentally sustainable?

The Taxonomy establishes six environmental and climate objectives:

- climate change mitigation;

- climate change adaptation;

- sustainable use and protection of water and marine resources;

- transition to a circular economy, including waste reduction and recycling;

- pollution prevention and control;

- protection and restoration of biodiversity and ecosystems.

To be environmentally sustainable, an activity must meet the following criteria:

- make a substantial contribution to at least one of the six climate objectives;

- have no significant negative impact on other objectives;

- be conducted in line with minimum social safeguards (e.g., those provided for by the OECD guidelines and the United Nations).

In this initial phase, the Taxonomy and the technical criteria only consider the first two of the six environmental and climate objectives. The document states that, “This Delegated Regulation specifies the technical screening criteria under which certain economic activities qualify as contributing substantially to climate change mitigation and climate change adaptation and for determining whether those economic activities cause significant harm to any of the other relevant environmental objectives”.

Experts at work: the TEG on Sustainable Finance

The first draft of the delegated acts containing the screening criteria was produced in 2020 by the Technical Expert Group on Sustainable Finance (TEG), the group of experts — 35 members and over 100 consultants — appointed in 2019 by the European Commission to provide recommendations on new sustainable finance regulations. The TEG was tasked with identifying the economic activities which contribute to achieving the target of zero emissions by 2050 and the relative selection criteria.

The outcome: 600 pages describing, in detail, the technical thresholds for each of the over 70 activities considered by the Taxonomy from agriculture to energy production, ICT to manufacturing, transport to construction.

Then, in September 2020, the TEG concluded its work, and the Platform on Sustainable Finance was created, composed of 67 members (50 permanent, 10 special observers, and seven public bodies represented), chosen — according to the notice issued by the Commission — on the basis of their “environmental, sustainable finance or social/human rights expertise”.

The Platform on Sustainable Finance is responsible for:

- advising the Commission on the adoption and usability of the technical screening criteria for the Taxonomy;

- advising the Commission on revisions to the Taxonomy Regulation, promoting the introduction of additional sustainability objectives including the social dimension, the current exclusion of which detracts from the environmental dimension;

- monitoring and directing capital flows towards sustainable investments, providing the broadest support to the Commission on sustainable finance policy.

The European Commission then produced a second draft of the Delegated Acts, which was made available for public comment until in December 2020 and received over 46,000 responses and some criticism. Ten Member States (Bulgaria, Croatia, Cyprus, Czech Republic, Greece, Hungary, Malta, Poland, Romania and Slovakia) successfully demanded that the publication of the Acts be delayed.

In April 2021, the Commission approved the first Climate Delegated Act of the EU Taxonomy, adopted on 4 June 2021, which defines the technical criteria to establish whether an economic activity can substantially contribute to the first two objectives of the Green Taxonomy: climate change mitigation and climate change adaptation. These criteria apply from 1 January 2022, from which date, financial operators are required to report if, and to what extent, the investments associated with their financial products are aligned with the Taxonomy.

In June 2021 the EU Taxonomy Compass was published. This digital tool aims to facilitate access to the contents of the delegated acts containing the technical screening criteria for Taxonomy-eligible economic activities. According to official EU documents, the tool “provides a visual representation of the contents of the EU Taxonomy, starting with the Delegated Act on the climate objectives adopted on 4 June 2021. Looking forward, the EU Taxonomy Compass will be updated to include future delegated acts”. The document will enable “users to check which activities are included in the EU Taxonomy (taxonomy-eligible activities), to which objectives they substantially contribute and what criteria they have to meet”. The EU Taxonomy Compass “also aims to make it easier to integrate the criteria into business databases and other IT systems.”

In addition to the first delegated act, on 6 July 2021 the Commission also approved the Delegated Act supplementing Article 8 of the Taxonomy Regulation. Article 8 provides specific indications to companies subject to the Non-Financial Reporting Directive (NFRD) on how to disclose public information on how and to what extent their activities are associated with environmentally sustainable economic activities. In particular, the supplementary Delegated Act specifies the content, methodology and presentation of the information that financial and non-financial undertakings must disclose on the economic activities that are aligned with the EU Taxonomy.

But the technical criteria issued on 21 April were not yet complete and did not address several very politically sensitive topics. The text of the delegated act omitted the two most discussed sectors, gas and nuclear, with any definitive decision on the matter postponed. The Commission took more time to try to find what it defined as a “delicate compromise” and draft a complementary delegated act that extended the first two objectives to the gas and nuclear sectors. This Complementary Delegated Act was adopted on 1 February 2022 and was approved by the European Parliament on 5 July.

Another delegated act for the remaining objectives (the sustainable use and protection of water and marine resources, the transition to a circular economy; pollution prevention and reduction, the protection and restoration of biodiversity and ecosystems) will be published in 2022.

The technical criteria: a challenging deal

Why was it so difficult to reach an agreement on the technical criteria used to qualify economic activities as sustainable? Sustainable finance increasingly moves larger amounts of capital, and so being included or excluded from such investments carries its own weight. Consequently, industrial sectors or activities that risk being left out of these huge investments are working to ensure that this doesn’t happen. And the countries where those sectors are particularly prevalent have made their opinions known to the European decision makers.

Natural gas: a source of transition

One of the most contentious points involves the use of natural gas as an energy source. This was excluded from the drafts presented by the TEG and the Platform on Sustainable Finance. The emission threshold for obtaining the green label was 100 g CO2 equivalent per kilowatt hour, a threshold that no gas plant is able to meet, at least not at the moment. But without the EU’s green seal of approval, gas power stations stood to lose private investments worth billions of euros. This problem was felt most acutely by countries in Eastern Europe, where combined cycle gas plants are facilitating the transition from coal. However, they produce around 300 to 350 g of carbon, far above the threshold set by the Taxonomy.

Can we do without gas?

The International Energy Agency (IEA) includes gas among the fuels considered in its analysis of sustainable development scenarios. The outlook produced by the IEA aims to calculate how the global energy sector should evolve in order to meet the following sustainable development goals in a realistic and cost-effective way: achieve universal access to energy (SDG 7), reduce the severe health impacts of air pollution (part of SDG 3), and tackle climate change (SDG 13).

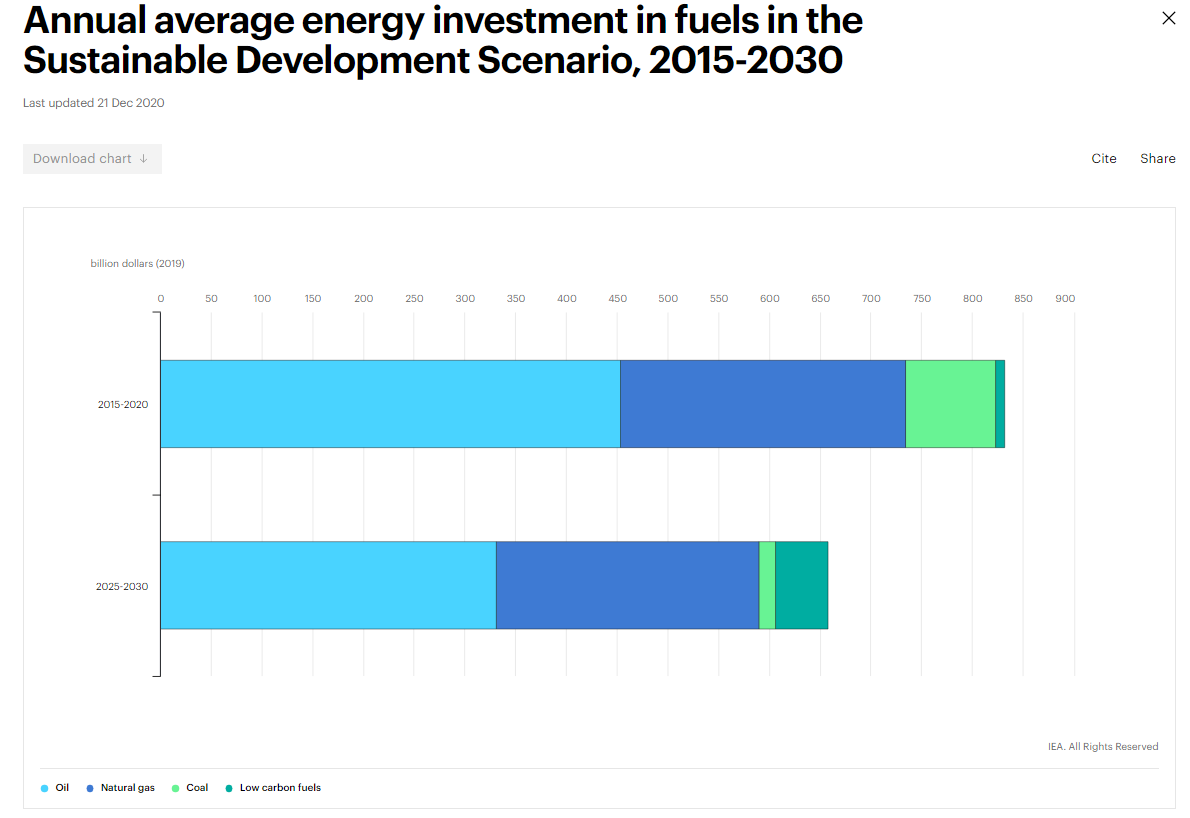

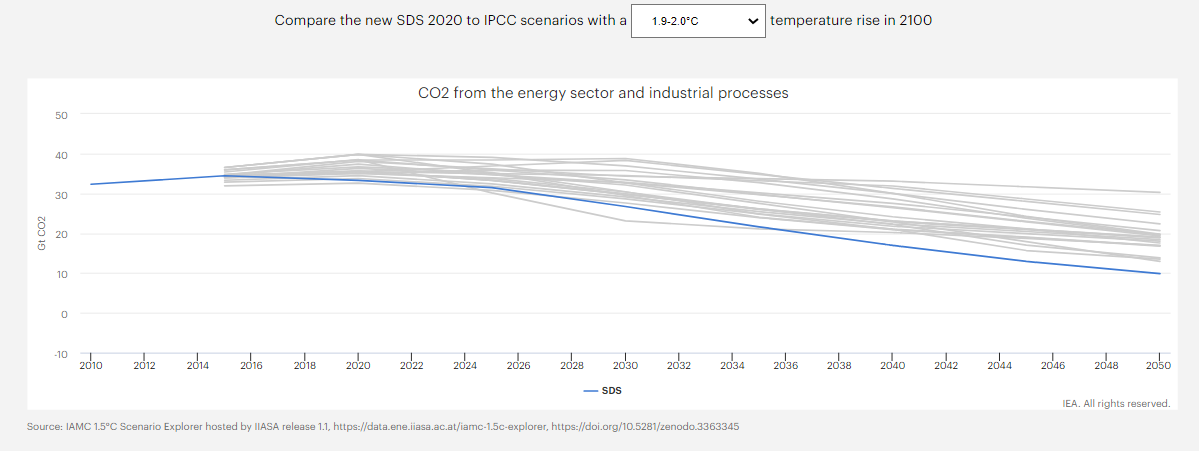

As shown in the figure below, according to the IEA scenarios for 2030, investments in gas are unavoidable. Gas is considered essential to replace coal (which has much higher emissions) and provide flexibility and storage capacity to the energy supply system to cope with peaks in demand (which renewable energy sources are not yet able to fully guarantee).

The IEA’s scenario for 2030 is in line with a less than 2 degrees scenario. In other terms, even if we invest in gas in the next decade, the IEA estimates that the energy system can maintain a sustainable trajectory and guarantee a global temperature rise in line with the target set by the Paris Agreement in 2015.

Nuclear: France stakes its claim

Another sector characterised by intense economic interest is nuclear power. This sector is somewhat controversial, not so much due to the polluting emissions it generates (which are generally low) but more due to the issue of managing nuclear waste. This is still a very difficult process and could violate the second rule, according to which each activity must not only contribute to the adaptation and mitigation goals, but also avoid harming the other objectives (biodiversity, circular economy, protection of marine resources, pollution prevention).

And pressure on this issue has been very strong, especially from countries like France, so much so that at the end of March 2021 French President Emmanuel Macron wrote a joint letter to the European Commission along with six other Heads of State (Poland, Romania, Hungary, Czech Republic, Slovakia and Slovenia) to request that nuclear power not be excluded from the EU Taxonomy.

Other sectors that want in on the Taxonomy

In the latest draft of the delegated acts, aviation is also named as a transition activity. Greenpeace has condemned the move: “Air travel is the mode of transport with the highest climate impact”. Hydrogen would also be permitted under certain conditions. The production threshold was increased to 3 kilograms of CO2 equivalent per kilogram manufactured (in the first version, it was 2.256). Again, this was a request that came specifically from industry. However, the rules on manufacturing new batteries have been tightened, with recyclability now required.

Another sector is biogenergy produced by burning wood, which, according to the Taxonomy, could be “sustainable”. This has also been rejected by environmentalists. The same goes for hydroelectric power stations, now included among sustainable categories, but which many NGOs believe should be excluded due to the damage caused to biodiversity.

Another disputed factor is plastic, considered sustainable by the Taxonomy if it is “completely produced using mechanically recycled waste plastic” or using chemical recycling processes, provided the minimum emission standards are met.

Complementary delegated act: yes to gas and nuclear

As we noted above and against the experts’ advice, on 2 February 2022 the Commission approved a Complementary Climate Delegated Act that included certain specific activities in the nuclear energy and gas sectors among the economic activities considered environmentally sustainable under the EU Taxonomy.

The Commission’s website states that: “The criteria for the specific gas and nuclear activities are in line with EU climate and environmental objectives and will help accelerating the shift from solid or liquid fossil fuels, including coal, towards a climate-neutral future”.

According to the Commission, these are “transition activities”, meaning they cannot yet be replaced by technologically and economically accessible low-carbon alternatives but contribute to climate change mitigation and can play an important role in the transition to a climate-neutral economy.

In particular, the Commission clarified that “the text sets out clear and strict conditions, subject to which certain nuclear and gas activities can be added as transitional activities to those already covered by the first Delegated Act on climate mitigation and adaptation, applicable since 1 January 2022. These stringent conditions are, for gas and nuclear, that they contribute to the transition to climate neutrality, for nuclear, that it fulfils nuclear and environmental safety requirements, and for gas, that it contributes to the transition from coal to renewables”.

The Complementary Delegated Act on Gas and Nuclear Energy was approved by 278 votes in favour, 328 votes against, and 33 abstentions. A majority of 353 MEPS out of the total 705 would have been needed to object. As a result, gas and nuclear power will be able to boast a green licence as of 1 January 2023, joining the economically sustainable activities recognised by the European Union.

In order to ensure transparency on the gas and nuclear exposures of investments, more information on the Taxonomy will have to be provided. The European Supervisory Authorities (ESA) are already developing these disclosures following a mandate received from the European Commission on 8 April. Further information will also be requested on the income generated by EU green bonds that finance gas and nuclear projects.

Gas and Nuclear included in the Green Taxonomy: engineers, associations, institutions and experts condemn the move

The Commission’s decision has provoked protest from multiple fronts. In a position paper, Eurosif (European Sustainable Investment Forum) expressed concern and regret, stating that it “acknowledges the approval in principle of the Taxonomy Complementary Delegated Act and understands the political context and motivations which led to the inclusion of natural gas and nuclear energy in the EU Taxonomy framework. Nevertheless, we regret the probability that this decision will adversely impact the credibility and usefulness of the framework for sustainable investors, thereby hampering the very objectives of the EU Green Deal it is seeking to support”.

Eurosif emphasises that, “There are doubts about the robustness of the Technical Screening Criteria for natural gas and nuclear energy activities. The inclusion of these activities disregards the scientific basis applied to other activities with a role to play in climate change mitigation. Besides, it contravenes the principle of technological neutrality enshrined in the Taxonomy Regulation. The Eurosif document also cites the opinion of the Platform on Sustainable Finance which stated in its feedback to the Complementary Delegated Act that, “The Technical Screening Criteria (TSC) differ in fundamental ways to the TSC in the climate Delegated Act and are not consistent with the provisions of the Taxonomy Regulation”. The Platform also highlights that the TSC do not ensure no significant harm to the other objectives established by the Taxonomy.

The European Parliament’s vote also sparked protest from certain parties and environmental associations. Greenpeace has announced that it will file a formal request for review of the Delegated Act and, if this is rejected, will take legal action against the Commission with the European Court of Justice.

Gas and Nuclear included in the Green Taxonomy: where does Etica Funds stand?

The position of Etica Funds on this topic is clear. The decision to include gas and nuclear risks undermining the entire credibility of the green regulatory framework. Leading experts agree that gas is a climate-changing source and that nuclear power plants pose significant safety and radioactive waste management problems. Moreover, the new nuclear technologies that would allow for greater safety and even greener production do not yet exist, and the costs are very high and the times lines very long.

Transition energy sources should be considered temporary solutions and, as such, should have no trouble in securing funding on the market. Introducing them into the Taxonomy will lead to a slower transition and, we believe, is a mistake.

We are aware of the energy supply problems that the world is currently facing, but we believe that those who want to work to combat climate change and inequality must make bold choices that can no longer be postponed and focus on renewable energy sources.

With regard to nuclear, when it comes to making cost-benefit analyses, Etica Funds believes that it is essential to expand the field of vision to other externalities because, as the Belgian Conseil Supérieur de la Santé noted in its report, “The reality is more complex, and nuclear energy presents its own risks and poses serious questions” (Conseil Supérieur de la Santé. Risque nucléaire, développement durable et transition énergétique. Brussels: CSS; 2021. Avis n° 9576). Being “sustainable” means more than low CO2 emissions. Scienzainrete (“Il nucleare non è la soluzione”, Vincenzo Balzani, 19 December 2015) suggests considering other factors as well.

- Nuclear power plants produce dangerous radioactive waste for tens of thousands of years. To date, no form of nuclear power has found a satisfactory solution to this problem.

- Decommissioning and demolishing nuclear power plants presents several challenges from an economic and a technical perspective. Italy, for example, abandoned nuclear power several decades ago but still has to manage the decommissioned plants and waste, with the costs borne by consumers in their monthly electricity bills.

- Uranium is a scarce resource and concentrated in certain areas of the planet. This makes it a highly contested resource and could lead to geopolitical tensions. Civil nuclear is closely connected to military nuclear, with possible ramifications for international security. To find out more, please see the article by Walter Ganapini, a member of the Ethics Committee of Etica Funds.

- We cannot disregard the risks of possible accidents, the consequences of which cannot be quantified and can last for centuries. We all remember Chernobyl and, more recently, Fukushima in Japan.

When it comes to fossil fuels, Etica Funds has always excluded coal and oil from its funds’ investments, working towards improving decarbonisation strategies and abandoning fossil fuels altogether and making a major bottom-up contribution to drive this change by influencing corporate behaviour. For more information on the methods adopted by the funds, please see the “Selection” page of our website. We have recently taken a step forward by reviewing our investment policy for companies that, in various capacities, deal in activities associated with natural gas. These companies are currently barred from the investments in our funds, with the exception of those able to present a convincing transition plan. We apply a specific ad hoc methodology to evaluate the credibility of the pledges made, assessing their management, ambition and effectiveness, with a view to identifying actors that, once they have overcome their dependence on this fossil fuel, will be able to make a positive contribution to the energy transition

Social factor: currently postponed

In the course of the European Commission’s extensive work to define sustainable finance, there is clearly room for improvement on the environmental criteria. Yet, most importantly, the Taxonomy must be expanded to include social criteria (one of the three key ESG factors, (environment, social and governance).

It is not enough to merely specify that minimum social safeguards must be met by aligning the OECD guidelines for companies with the Guiding Principles on Business and Human Rights of the United Nations is essential. The Platform on Sustainable Finance is currently working on this area, and is drafting the social criteria to be integrated with the environmental factors used to qualify sustainable activities.

On 12 July 2021 the Platform published the first draft proposal for a social Taxonomy. The aim is to extend the current Taxonomy by supplementing the six environmental objectives with a series of social objectives and sub-objectives. The document also proposes approaches and criteria to define the “substantial contribution” of an economic activity to one or more social objectives and the Do No Significant Harm principle. These draft technical criteria for the development of a social taxonomy were made available for public comment (until 6 September 2021), and the Platform had hoped to be able to publish the final report in Autumn 2021 to enable the Commission to make a decision on the issue before the end of the year. However, the deadline has been postponed to the first quarter of 2022.

Who is the Green Taxonomy for?

The Taxonomy aims to provide the language of sustainability and be a reference for the financial sector (which has to indicate how sustainable an investment actually is), for governments (which have to establish incentives for green businesses) and for companies (which have to report their environmental impact).

- “Those who offer financial products in the EU, including pension funds” will have to provide information on the relevance to the Taxonomy of the products they offer. There is a range of varying obligations depending on the sustainability classification of the product and whether it refers to the entire fund (or strategy) or part of it.

- For each product, from 31 December 2021, operators on the financial markets are required to declare if and to what extent the underlying investments are aligned with the Taxonomy, expressed as a percentage of the investment, fund or portfolio.

- Publicly traded companies with over 500 employees, banks and insurance companies subject to the Non-Financial Reporting Directive (NFRD) will be required to provide information on their activities with regard to the Taxonomy.

- While the method has not yet been established (this will be decided by the platform of the European Commission), the Taxonomy will also be the reference used to allocate European incentives. According to the Final Report, “ The European Commission is considering how the Taxonomy can be applied in the climate and environmental tracking and sustainability proofing guidelines of the InvestEU Programme”.

European Taxonomy: the next steps

What are the next steps for the Taxonomy? When will other obligations for sector operators come into force?

- First of all, the environment delegated act will be issued which will contain the technical screening criteria for the remaining four objectives established by the European Commission (pollution prevention and control, the use and protection of water and marine resources, the circular economy, the protection and restoration of biodiversity and ecosystems).

- This Delegated Act should come into force by the end of 2022. Financial operators will be called upon to report their alignment to these objectives from 1 January 2023.

- The report containing the technical screening criteria for the Social Taxonomy should be published in 2022.