Engagement Report 2021 is the name of the document which analyses the results achieved through our dialogue with the management and voting at shareholder meetings of companies in which Etica Funds invests.

What does engagement mean?

It is “the process through which the investor initiates structured dialogue with the management of the subsidiary company (and/or company under review), on the basis of the continuous monitoring of the environmental, social and governance factors related to company activities” (definition by the Forum per la Finanza Sostenibile [Italian Sustainable Investment Forum]).

Etica Funds engagement is mainly carried out in two ways.

Results of the dialogue

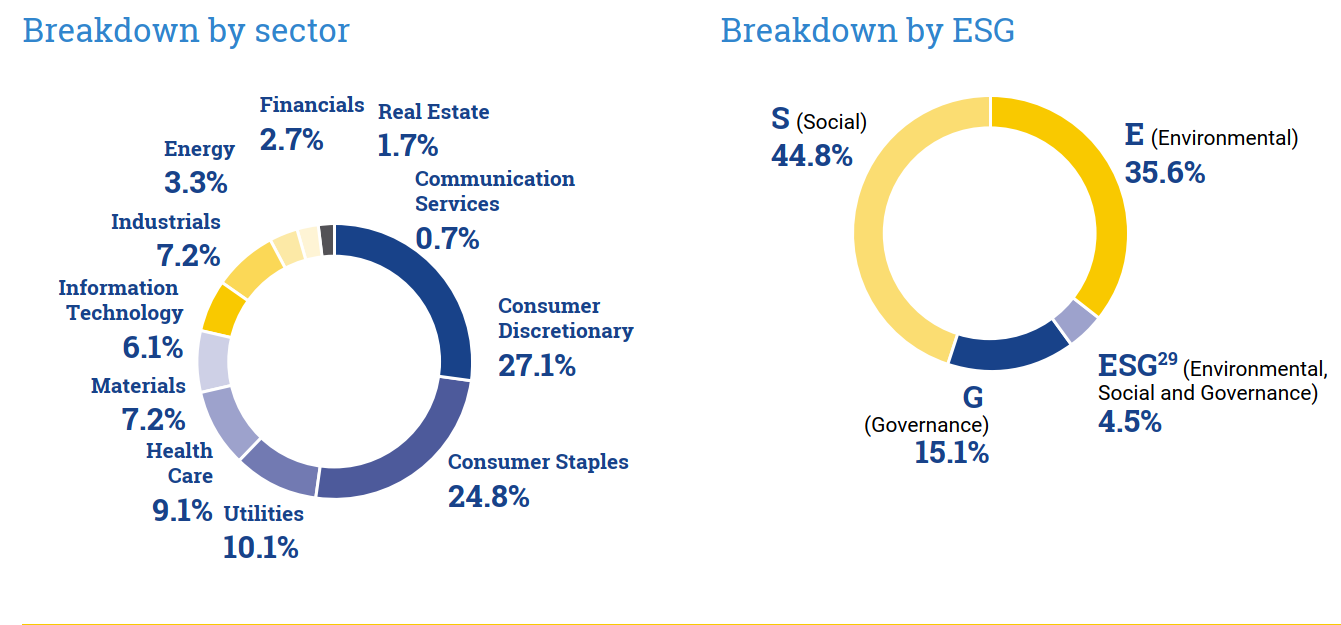

During 2020, we engaged in dialogue with 230 international companies, posing almost 700 questions to managers on socio-environmental and corporate policy issues. Etica dialogue was undertaken with written requests for information, organising conference calls, meetings or workshops with businesses.

234

International companies with which Etica engaged in dialogue

694

Questions on ESG issues posed by Etica

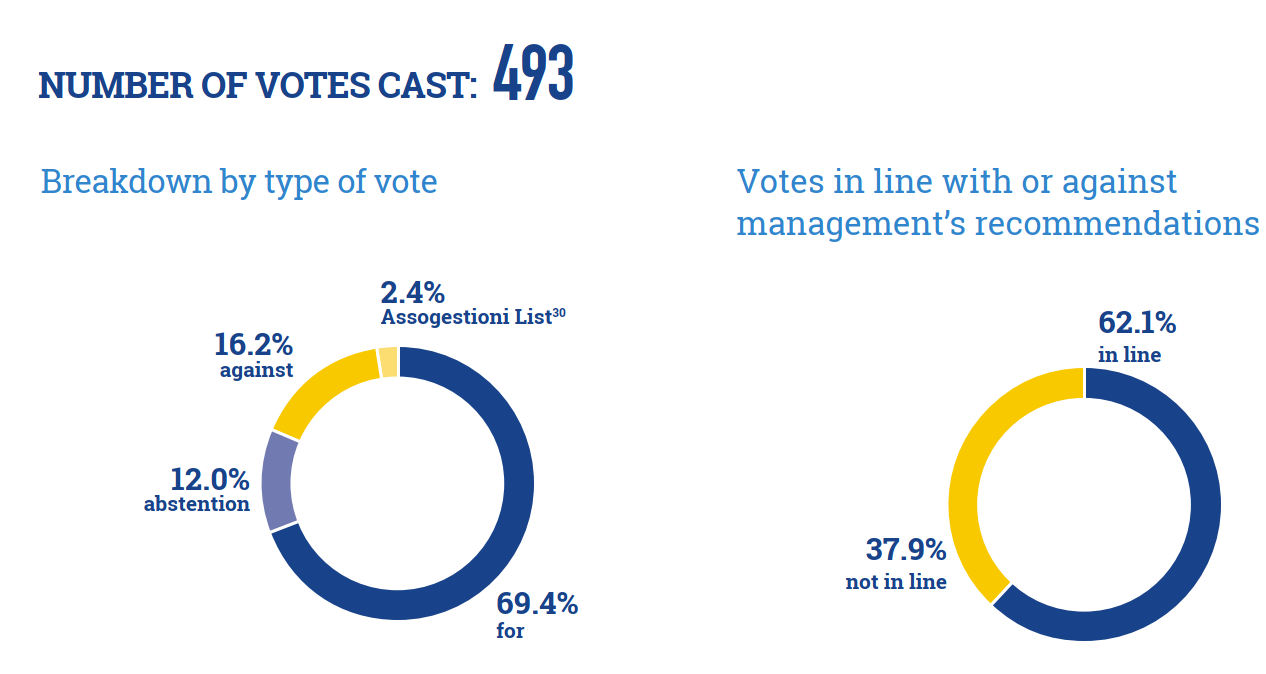

Results of the voting

During 2020, we took part in 49 shareholders’ meetings of 49 companies, voting on 493 agenda items. Voting by Etica at said meetings, known as shareholder engagement, took place through participation in shareholders’ meetings for Italian companies and voting via an electronic platform for foreign companies.

49

Number of shareholders’ meetings in which Etica Funds voted

493

Agenda items addressed

37.9

Voting percentage not in line with management’s recommendations

Download the Engagement Report 2021

Why does Etica focus on engagement activities?

There is solid evidence that shows that engagement, if undertaken appropriately, can have a positive influence on the behaviour of a company and that this influence can generate long-term value. In particular, some academic studies show that

There is a positive correlation between companies’ responses to investor engagement on ESG issues and their performance.

Engagement on ESG issues can reduce downside risk.

Engagement on ESG issues can help to improve the risk/return profile of a shareholding portfolio.

Please read the Notice.