The Impact Report for the first time measures the social, environmental and governance impact of Etica Sgr’s equity investments.

Our aim is to inform our clients of the current and future effectiveness of our screening process, allowing us to invest exclusively in companies which pass a rigorous assessment based on environmental, social and governance (ESG) criteria.

Socially responsible investing lets investors play an active role in the economy through the environmental and social impact of their investments.

How to calculate the impact?

By examining a range of indicators consistent with the United Nations’ 2015 Sustainable Development Goals (SDGs) and comparing them with a basket of firms that reflect the market, which are NOT subject to the screening process.

Sustainable develpoment goals

The 2030 Agenda for Sustainable Development is a plan of action signed in September 2015 by the governments of the 193 UN Member States, which sets out 17 shared international development goals to be achieved through a combination of economic growth, social inclusion and environmental protection.

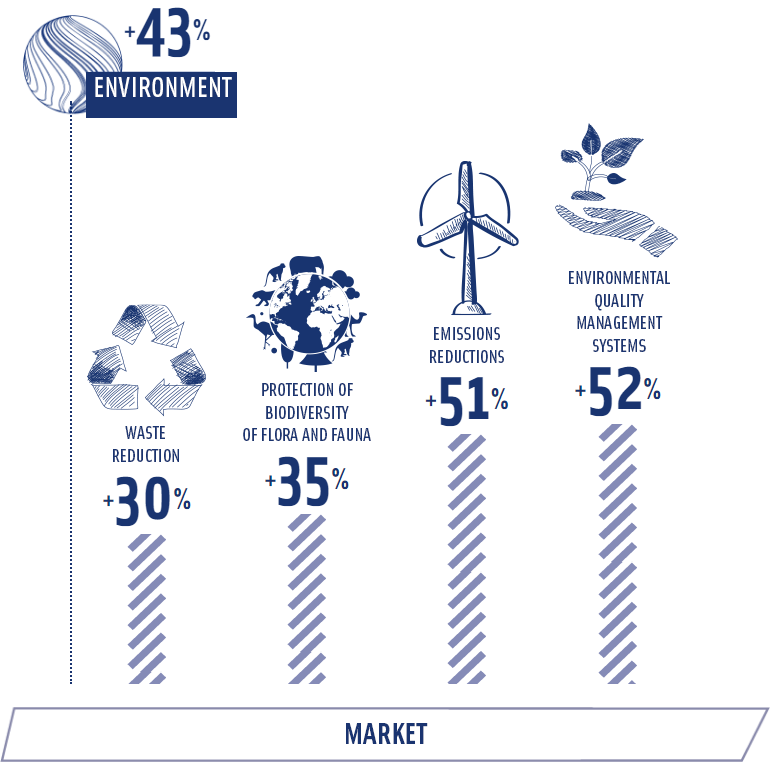

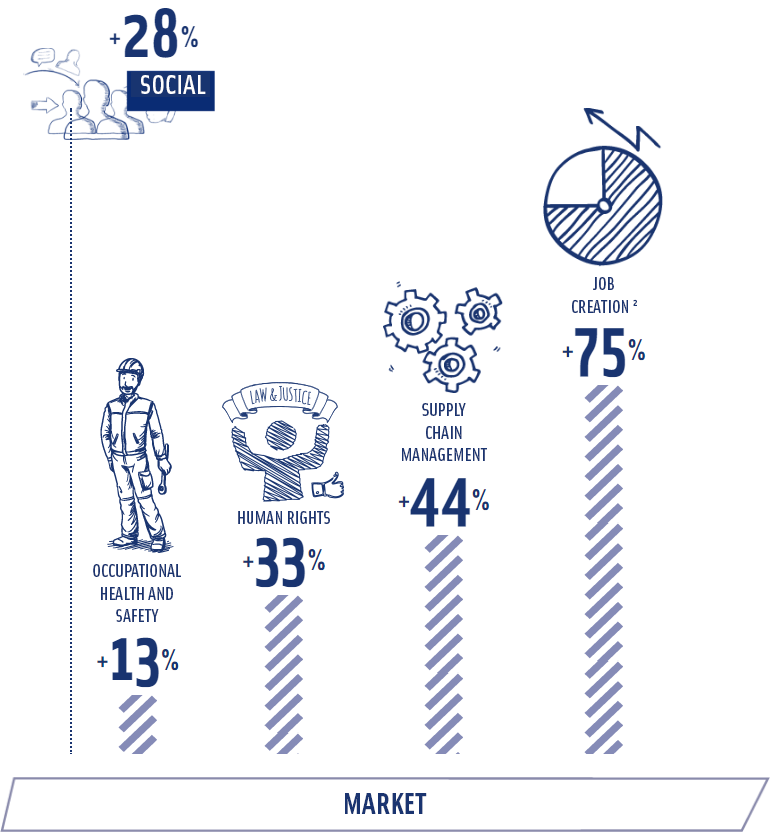

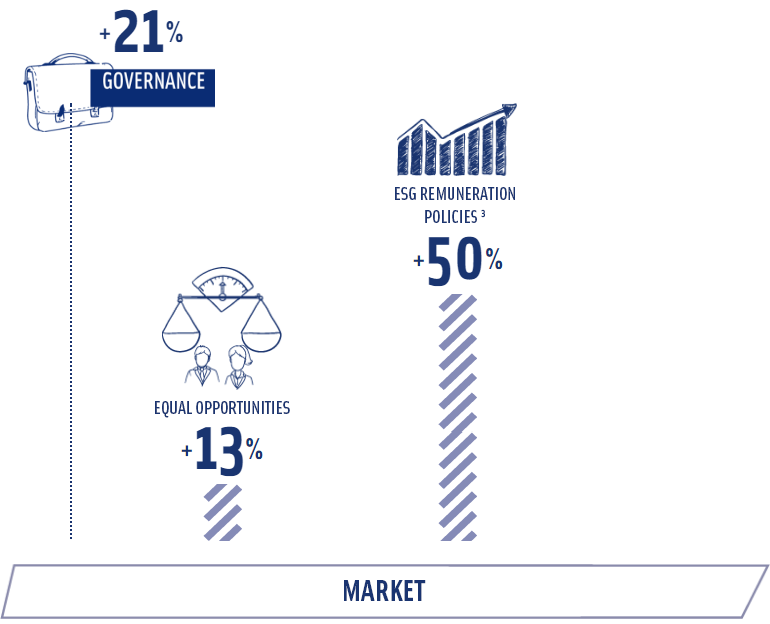

What is Etica Azionario’s ESG impact on average compared with the market?

Market comparison of fund companies in terms of sustainability issues1

-

Methodology

Etica Sgr obtains these results from careful analysis, research and evaluation on the basis of Bloomberg data.

The companies considered in the analysis for the Etica Azionario fund refer to the composition of the fund at 31/12/2016. The market benchmark used was the iShares MSCI ACWI ETF at 31/12/2016 (ISIN: US4642882579).

Altogether 75 indicators consistent with the Sustainable Development Goals were identified and analysed (20 environmental, 13 social and 24 governance besides 7 exclusion indicators and 11 linked to International Conventions). Among these, the analyses focused on the Goals with a high level of indirect materiality, as defined by our Social Responsibility Policy, and strategic in dialogue with the companies.

In choosing the indicators for impact analysis we considered only those with at least a 70% data coverage for the Azionario Fund and the iShares MSCI ACWI ETF, except for the SDG 13 indicators which have a coverage of 67% and the impact indicators for the exclusion of controversial industries, which have a coverage of 64%.

The composite indicators (+43%, +28%, +21%) represent the average percentage differences between the values of the companies (again in percentages) which satisfy the individual impact indicators in the Etica Azionario fund compared with the market benchmark (iShares MSCI ACWI ETF).

The composite indicators take into consideration all of the indicators examined and not only those mentioned in this report.

1The data refer to the number of companies in which the Etica Azionario fund invests which are committed to ESG issues on each of the indicators represented (waste reduction, protection of biodiversity, emissions reductions, environmental quality management systems). The composite ESG indicators, on the other hand, take into account all aspects covered by the analysis (e.g. for “environment” the calculation is not limited only to waste reduction, protection of biodiversity, emissions reductions, and environmental quality management systems). The data are expressed as a % of the market benchmark, (iShares MSCI ACWI ETF). For more details, see Methodology.

2The companies in which Etica Azionario Fund invests have generated on average 75% more jobs than the market over the last year.

3This refers to ESG targets linked to variable salary, i.e. the portion of directors’ and top management salary linked to performance and corporate targets achieved.

Before subscribing, please read the KIDs and Prospectus available from placing agents.

The placement of the “Linea Valori Responsabili” and “Linea Futuri Responsabili” funds is only available in Italy. For further information, please refer to the Italian version of the website.